Now step back for a second and answer this: who are you more likely to recall when someone mentions GenAI —MidJourneyAccenture? I am pretty sure it’s the former. There’s no doubt that MidJourney has built something amazing, even unreal, and may very well dominate its vertical for the next decade. But for now, the less-sexy services company is making more money.

Which leads me to a related topic for the technology sector at home. Ever since the global startup boom, we all have probably heard how Pakistan needs to focus on building products. This school of thought has many takers …. Just look at the difference in media coverage of product and service companies.

They present a range of arguments to support their claims. Perhaps none more than that products are scalable: unlike services, here you don’t need to proportionally increase costs in order to grow revenues. Examples like WhatsApp pre-acquisition or Telegram now are cited. Now before proceeding, let me just make it clear that I don’t necessarily disagree with that view. There’s absolutely no doubt products can be truly revolutionary.

But is that obsession really right, or even justified, in the case of Pakistan? In isolated verticals, maybe but at a national level, I feel there’s a genuine need to build a narrative for a more service-oriented approach. Let me explain why. First of all, product businesses are both extremely costly and risky. Take Careem, which is still the biggest exit from the entire MENAP region. Despite raising $774 million since inception, the company is yet to post a profit and has lost market share to competitors in multiple countries.

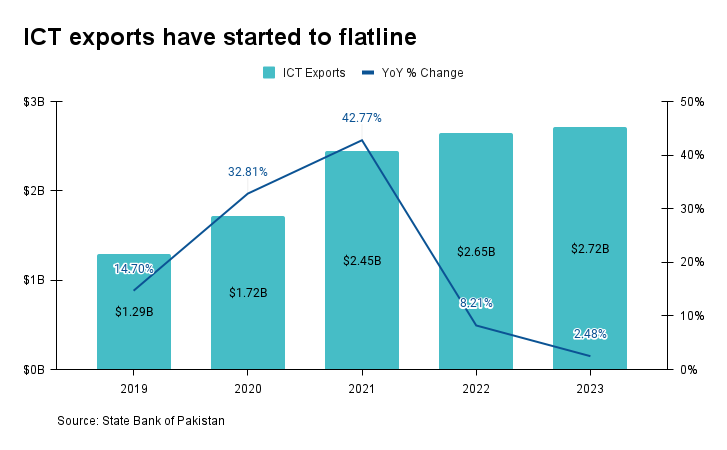

That’s a serious amount of money, with which you could probably buy a sizable IT services company doing $300 million annual revenue at a 20% net margin. Now, obviously such sums of capital are not flowing into Pakistan anyway but even if they were, wouldn’t it be more valuable to have an organization that adds hundreds of millions to our export earnings? For a country like ours, this is actually critical.

Perhaps more importantly, such an entity would likely be employing 10,000-15,000 people directly, which is between 1.7% and 2.5% of Pakistan’s IT work force. This actually brings me to the second point: the fact that service companies need more human resources to scale is actually a positive, not a negative. Anyone helping generate higher skilled employment adds tremendous value to the economy, whose effects reverberate across different geographies and even generations.

India’s IT sector is a case in point. As a developing economy with abundant human resources at competitive prices, they positioned themselves to be an attractive offshore destination. This is how Bangalore, which some refer to as the Silicon Valley of Asia, blossomed and eventually became the home for product companies like Flipkart, Swiggy, and Zepto. So there’s a natural trajectory for everything, including products.

Even in mature ecosystems, we shouldn’t discount the potential of services. Sticking to India, consider how the leading IT company, TCS ($167B), is 56x compared to one of the most-funded startups, PayTM ($5). Given their high margins, service companies have also served as a key source of capital through aggressive mergers and acquisitions, including abroad.

Not only that, due to their export nature, most large service companies set up foreign sales offices, which then helps provide local talent with a pathway to move abroad. That unlocks another source of forex inflows in the form of remittances, in addition to providing valuable upskilling opportunities.

None of this is to argue against inculcating a product-driven mindset, where there’s perhaps greater potential to do cutting-edge work. Or build iconic brands, which people can associate with a certain country. Think Skype and Estonia or Turkey and Peak Games. Plus, they certainly attract higher multiples from investors and typically raise more capital. Cloudways, which was acquired by Digital Ocean for $350 million, is a perfect example of this from Pakistan itself.

But while such winners may be bigger, they are also fewer in number. For Pakistan, a less risky approach at this point would may be to focus on the basics and create a healthy ecosystem, with a solid talent pipeline, which can then help us make our mark in the world of global products.

0 Comments